Brands and marketers are adapting to the newest marketing strategies for upscaling their businesses. From creating the most amazing user experience for customers to providing them with the utmost services to the clients, the business landscape has been enhanced a lot. But considering the competitive business world, acquiring new customers is not enough, rather they should focus on long-lasting relationships with their existing customers. In fact, studies show that it costs up to 7 times more to acquire a new customer than to retain an existing one.

Customer Lifetime Value (CLV) helps you monitor the same. In simpler words, lifetime value helps us understand the value a customer adds to your business. To understand it more deeply let’s read further on how you an elevate your business game and achieve success.

What is Customer Lifetime Value?

Customer Lifetime Value refers to the process of analyzing the value that a customer brings to your business. The repeat purchase, potential customers, and their constant interaction with your business can be measured by monitoring CLV.

Personalized User Experience:

By analyzing your user behavior and understanding the customer journey, you can take a proven decision on enhancing your user experience. Monitoring these data insights you can send them personalized ads, offers & discounts, give recommendations, etc. This will keep your customer engaged with your content and there are more chances of conversions in such a situation. Creating exciting emails and sending them interesting push notifications can take them directly to your product and increases the chances of conversion. This will boost CLV and also enhance customer satisfaction.

Customer Retention:

As a business, you would want new customers to come to you every day, but this is quite difficult. But retaining your customers is somewhere that you can do easily. Hence, to have a constant and successful growth for your business you should focus on customer retention. From providing them with amazing offers, satisfactory services, conducting loyalty programs, etc you can connect with your customer more effectively. This keeps your customer bond stronger and increases customer loyalty, which ultimately leads to higher CLV.

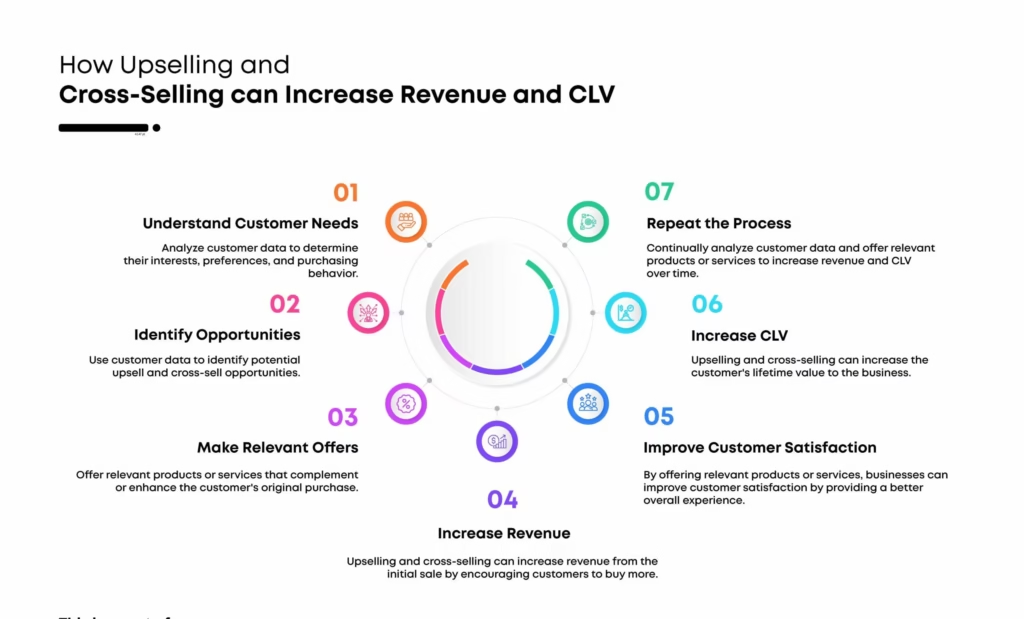

Upselling and Cross-Selling:

Showcase your products to your customer in an effective manner, highlighting their features or offering freebies along with them. This increases customer engagement and maximizes lifetime value.

Effective Customer Support:

You should always look forward to feedback from your customers. Helping them with their queries, listening to them effectively, and responding to their problems immediately will lead to trust building and increase customer loyalty. Effective support systems have a great influence on customers that keep your customer retained and they keep coming back to you for services.

Enhanced Product Delivery:

If you want to create long-term relationships with your customers, you need to deliver them the best of your services and products. Brand building and keeping it constant will lead your business to success. You should keep in touch with the customers through emails, SMS, notifications, etc for informing them about your latest offers or information. This increases app engagement and boosts CLV too.

Connection Via Social Media:

Nowadays social media platforms are the most effective and easiest way to reach your customers. Everyone is on the phone, it is very obvious that if they see your product ad while scrolling through Instagram, they would once click or view it. This results in customer engagement and interaction which ultimately leads to potential customers. You can keep your customers engaged and informed about your product updates, new launches, or offers & sales through social media in just no time. This is one of the most effective ways to enhance your brand visibility and also increase customer loyalty.

Understanding your Customers:

Divide your customers into segments rather than keeping all of them in the same group. Based on their behavior, preferences, needs, and choices you should differentiate your customers to take better decisions and acquire new customers too. Understanding your customer is the most important for a better user acquisition strategy.

Monitor Data:

Analyze your data effectively and use proactive engagement tactics to connect with customers. This enhances brand loyalty and trust for your customers. Such data analysis keeps you updated about your customer behavior and helps you make effective decisions.

Conclusion

Implementing these strategies into your marketing plan isn’t just about growth, it’s about sustainability. When you understand and optimize CLV, you’re not just increasing revenue per customer, you’re strengthening long-term relationships that fuel brand loyalty and repeat purchases.

From improving customer retention to personalizing the user experience and leveraging upselling and cross-selling, each tactic plays a vital role in helping you increase customer lifetime value.

Businesses that know how to increase customer lifetime value are able to reduce acquisition costs, build consistent engagement, and create more meaningful connections with their audience. Remember, loyal customers are not just transactions, they are long-term assets who contribute to steady ROI and business growth.

Start today by analyzing your customer data, segmenting effectively, and delivering personalized experiences that make every customer interaction count. That’s how you truly increase CLV and drive your business toward sustainable success.

For more information, contact us!

FAQs

1. What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) refers to the total revenue a business can expect from a single customer throughout their relationship. Understanding CLV helps you make informed decisions about marketing spend, customer retention, and long-term profitability.

2. Why is Customer Lifetime Value important for businesses?

Knowing your CLV allows you to understand how much each customer contributes to your business. This insight helps optimize marketing efforts, allocate budgets efficiently, and ultimately increase CLV through improved engagement and retention.

3. How to increase Customer Lifetime Value effectively?

To increase CLV, businesses should focus on improving user experience, offering personalized recommendations, running loyalty programs, and maintaining consistent post-purchase engagement. The more value you deliver, the longer your customers stay loyal.

4. What factors influence CLV?

Several factors affect CLV, including purchase frequency, average order value, retention rate, and customer satisfaction. By improving these areas through data-driven insights, you can understand how to increase customer lifetime value strategically.

5. How can personalization help increase CLV?

Personalized experiences such as tailored product recommendations, exclusive offers, and targeted messaging make customers feel valued. This increases satisfaction and loyalty, both of which are key to increasing CLV and boosting overall business ROI.