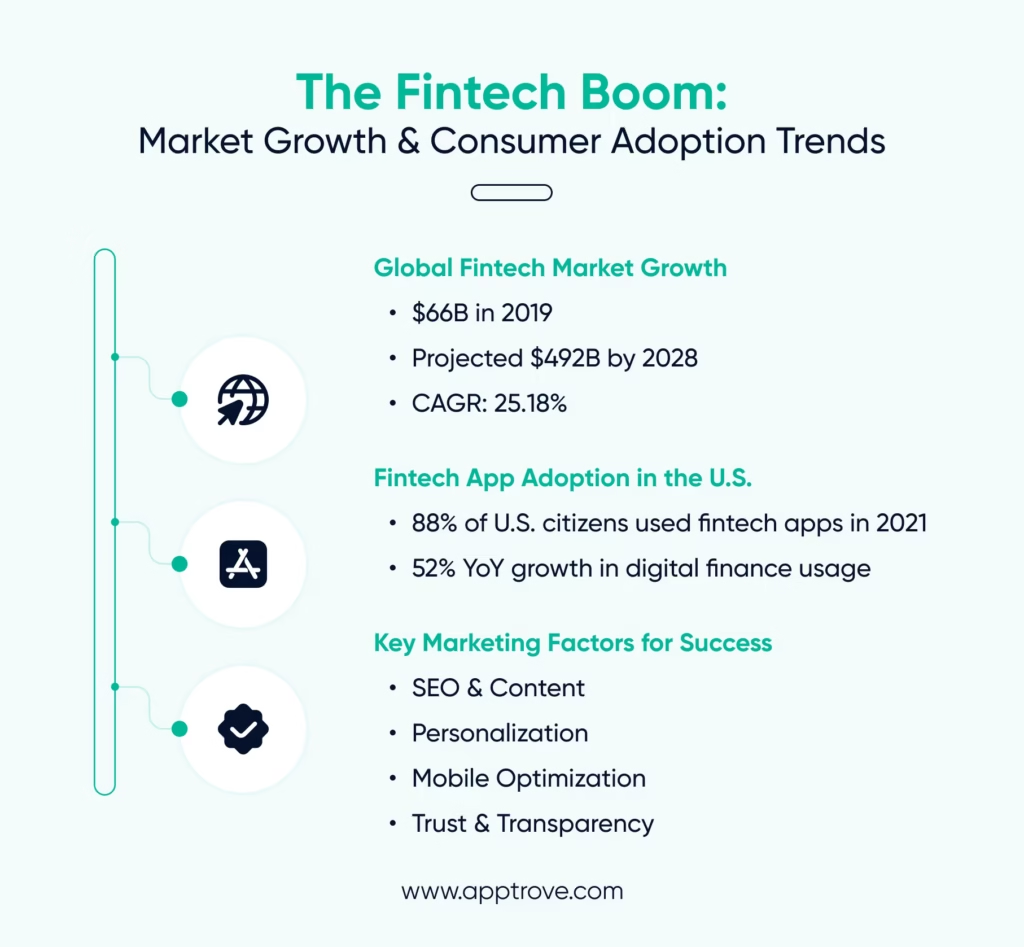

The necessity of a fintech marketing strategy, which is both sound and comprehensive, can not be overstated in the present-day fast-changing financial landscape. Especially for those companies that would like to take their place in the market. The global fintech industry, which will have grown from $66 billion in 2019 to a whopping $492 billion by 2028, with an outstanding compound annual growth rate (CAGR) of 25.18%. This presents a multitude of challenges to players. Also, it’s not only the move towards a digitalized world that holds an impact.

There is also a more significant demand for that from consumers as at 2021, about 88 % of U.S. citizens have, turned to the utilization of fintech mobile applications and other digital platforms to manage their finances, making it a 52% year-on-year increase. In addition to that, the competition now is so driven that companies must be able to identify the appropriate target market through such means as strategic marketing in order to gain the trust of consumers, which will also let them, in turn, produce loyalty and strong customer relationships.

What is a Fintech Marketing Strategy?

A marketing strategy for fintech is essentially a well-thought-out roadmap that cannot be exempted from the business model of companies either from the fintech field that will be used to advertise corresponding tools and win over their clients. Promotion of products is a process that requires detailed customer needs analysis and showing how a fintech product meets them. This plan encompasses various marketing tools to effectively capture the target audience and keep them engaged.

Key Components of a Fintech Marketing Strategy

Have a detailed overview of the key components of a fintech marketing strategy.

- Understanding the Target Audience: Understand the questions that need to be resolved before converting the potential customers of the financial sector into true followers. Cover people’s financial habits, problems they are trying to solve, and their data.

- Content Marketing: FinTech content marketers usually write resourceful blog posts, make videos, and create tutorials that educate their clients about financial matters and teach them how their fintech solution would help kid them out.

- Social Media Engagement: To engage with customers, platforms such as Facebook, Twitter, or Instagram can be utilized for purposes of interaction, uploading, and receiving feedback.

- Influencer Partnerships: You can partner with credible and approved individuals who can publicly support the fintech service. This will allow you to attain a wider audience.

- Search Engine Optimization (SEO): The fintech service will be visible at the top of search results when people are looking for money solutions online.

- Mobile Optimization: Since the vast majority of users are on smartphones, a mobile-friendly experience is a must-have for customer satisfaction.

- Customer Incentives: Get rewards, discounts, or referral bonuses to make more people sign up and get the old ones back.

These are the key and crucial components of a fintech marketing strategy. For a better output, pay attention to all of them.

Why is a Fintech Marketing Strategy Important?

The fintech industry is growing at a fast pace, and more and more companies are offering similar services today than in the past. A thoroughly designed Fintech Marketing Strategy is where a company outshines the others by:

- Building Trust: Money is a personal thing. The ability to reassure customers about their safety and the security of the service would make them feel comfortable and confident in using the product.

- Educating Customers: Fintech is not the easiest term to understand. Marketing makes things simpler for users by laying down the facts of the matter, which can be comfortable and help them to perform the technology of finance.

- Creating Brand Awareness: With so many products on the market, being remembered and lovable is the most important. A well-structured plan assures the retention of the brand in customers’ brains.

Five Effective Fintech Marketing Strategies for a Better Result

- Educational Content Creation: Information on data subjects and their authenticity is being disseminated via articles and videography. This stuff talks about budgeting tips and the proper use of the Fintech app effectively. Thus, it reaffirms the company’s position as a source of constant help and assistance to both new and old customers.

- Personalized Services: Loyal clientele can be cultivated by using data to present personalized financial suggestions or product choices. For example, the recommendation of financial planning tools or investment options that are based on the user’s behavior, the user engagement and satisfaction will be improved. Personalization, furthermore, builds a closer connection between the customer and the brand.

- Transparent communication: It is essential to inform the customer about charges, safety measures, and terms of service to build customer trust. Transparency is the key to keeping customers fully aware of what they are subscribing to and, thereby, avoiding doubts and promoting loyalty. Also, the communication of data usage and privacy policies helps customers to know that their information is secure.

- Responsive Customer Support: Helping your clients with good and quick support using the chat, email, or phone option solves the customer’s queries speedily. Smooth customer service improves the user experience and can transform an unsatisfied customer into a loyal advocate. Offering different ways of support to customers makes it quite easy for them whether they want to communicate online, which in turn also increases their success and satisfaction.

Challenges in Fintech Marketing

The success aspect of a fintech marketing strategy is dealt with in many aspects, while the issues arising are also of interest to the entrepreneur.

- Regulatory Compliance: Fintech firms need to do marketing that is not only user-friendly but also observes financial regulations to avoid running into problems with the law.

- Building Trust: Since Fintech is tied to crucial financial data, earning and preserving customer trust are very important.

- Market Saturation: In the fintech arena, the vast number of companies makes differentiation a challenging process that can only be conquered through the utilization of creative and buyer-oriented marketing methods.

P.S: Finance Apps in APAC need An Effective Attribution Tracking Solution, Here’s Why.

Conclusion

Focusing on startups and fintechs shall be the right decision to make. Fintech companies who wish to grow can select the clients they want to associate with. They do so by still being able to attract them by doing great market research, highlighting the right attributes or practices, and creating a bond of trust and appreciation. Moreover, it is the final output of implementing an effective and proven fintech marketing strategy. Through the implementation of such tactics, a fintech company is not only able to create a unique, different brand but is also able to create customer relations that are strong and long-lasting.

What is a fintech marketing strategy?

A fintech marketing strategy is a structured roadmap integrated into a company’s business model. It focuses on understanding customer needs, promoting fintech tools, and using various marketing channels to attract, engage, and retain clients effectively.

Why is a fintech marketing strategy important?

It is vital because it helps fintech companies build trust, simplify complex financial concepts, and stand out in a crowded market. A strong strategy also boosts brand awareness, customer loyalty, and long-term relationships.

What are the key components of a fintech marketing strategy?

Key components include understanding the target audience, content marketing, social media engagement, influencer partnerships, SEO, mobile optimization, and customer incentives. Together, these ensure fintech companies can effectively capture and retain customers.

What challenges do fintech companies face in marketing?

Major challenges include regulatory compliance, building and maintaining trust, and standing out in a saturated market. Overcoming these requires creative strategies, transparent communication, and customer-centric approaches that align with legal and ethical standards.