Asia has quickly evolved into one of the most vibrant and influential regions in the global mobile landscape. With billions of smartphone users, developing digital infrastructure, and a culture that favors mobile-first solutions, Asia has become an engine of new trends, technologies, and consumer behavior. Asia offers huge potential for scaling mobile businesses from well-established markets like China, Japan, and South Korea to fast-moving mobile economies like India, Indonesia, and Vietnam.

At the same time, the growth of mobile in Asia creates additional complexity. Distinct languages, cultural differences, regulatory environments, and competitive ecosystems create the need to understand what makes each market unique. With daily consumer experience rapidly changing, and mobile applications becoming essential for leisure, finances, shopping, and communication, the strategy used to acquire, engage, and retain users must adapt learning from each market.

By examining where digital ecosystems currently stand, shifting user trends, and emerging technologies, a clearer understanding is brought into focus as to how companies and brands can navigate this diverse and quickly changing environment. This snapshot of trends is based on the upcoming sections that will help understand how distinct markets within the region are shaping the future of mobile growth and innovation.

An Executive Snapshot of App Marketing in Asia

Undeniably, Asia has emerged as the engine room for the global mobile ecosystem, and its impact will be shifting the way apps are created, monetised, and scaled. The way we define the mobile app market is also changing, with Asia representing roughly a third of the global market share with app revenues in Asia Pacific predicted to be around $95 billion in 2024, and growing at more than 14% annually for the next decade.

At the same time, Asia has almost half of the global revenue share from smartphones, facilitated by a massive user base in large population markets and the explosion of low-cost Android devices.

What’s at stake in Asia: Scale, Speed, and Mobile-First Behaviors

For growth-oriented leaders, that translates into heightened competition, but also significant upside. Globally, consumer spending on mobile apps crossed the $150 billion mark in 2024, and Asia is a key contributor to that spend – with particular emphasis on gaming, entertainment, fintech, commerce, and productivity. Time spent in Asia is equally staggering: users in Asia’s leading markets cumulatively spend well above a trillion hours engaging with apps every year, underscoring how ingrained mobile engagement is in everyday behaviour.

2025 Macro Trends Shaping App Marketing in Asia

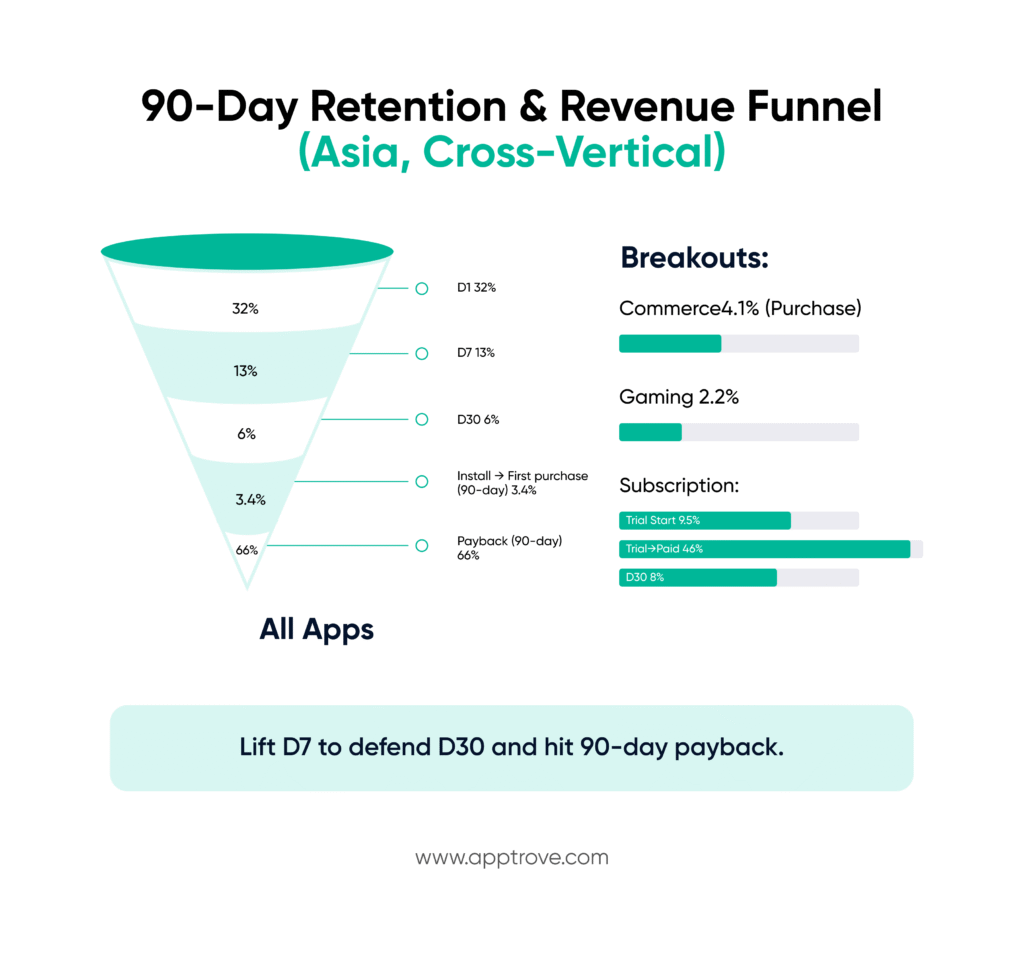

In this situation, App Marketing is not just a performance function in a niche discipline; it is now centrally relevant to growth strategy on a regional basis. App Marketing must balance paid user acquisition and the more sophisticated lifecycle tactics that come with onboarding optimisation, behavioural segmentation, retention campaigns, and re-engagement automations. With paid installs in Asia increasing by more than 20% year on year, and performance costs increasing, App Marketing teams must become sharper with measurement, incrementality testing, and creative optimisation.

Is it all about The Growth Equation: UA Efficiency, Retention, and LTV

Regulations and platform changes are also raising the strategic bar. Privacy controls, anti-fraud measures, and data-sharing restrictions mean App Marketing leads in Asia must invest in clean data infrastructure and privacy-safe targeting. At the same time, generative AI, automation, and real-time analytics redefine what ‘good’ looks like to App Marketing, from predictive bidding to dynamic creatives. The above forces, in combination, create a market where Asia is not just a numbers volume proposition, but a proving ground for the next generation of growth playbooks globally.

Market Landscape and Mobile Ecosystems

In Asia, the dynamics of the mobile ecosystem can be complex, and it is essential to take all of these factors into consideration when marketing an app. The following are the four key sub-areas that drive how app marketing can be approached across Asia.

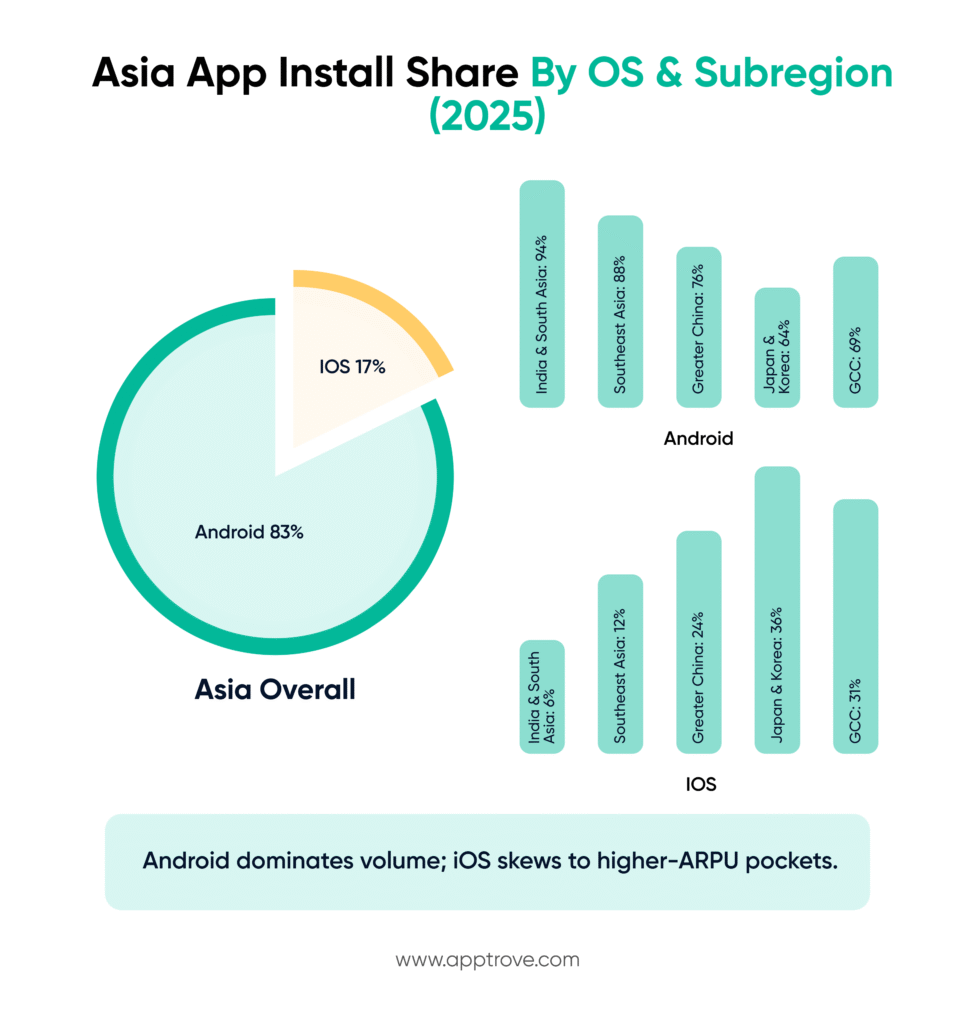

Android vs. iOS Share and What It Means for App Marketing

Android strongly leads mobile OS share within Asia, approximately 83.3%, compared to iOS at about 16.3%. For app marketing, this means Android is the clear priority for scale and reach, but iOS is still an important consideration for higher-value user segments. Due to Android’s competitive edge, app marketing budgets, acquisition channels, creative formats and attribution models will have to be Android first in many Asian markets. That being said, if a campaign entirely dismisses iOS, this could mean leaving premium users, high ARPU (average revenue per user) segments and high engagement potential on the table.

App marketing teams must be able to adjust for device-type, OS-split, Cost Per Install (CPI), retention profiles and monetisation expectations. In addition, the fragmentation of Android devices in Asia, with price tiers, form-factors and locations, complicates creative optimisation, localising content and measuring performance. In summary, app marketing effectively in Asia reflects a strong undercurrent of Android.

China’s Unique Ecosystem: No Google Play, Alternative Stores, and Super-Apps

China has a distinctive ecosystem that completely alters the way app marketing will need to be implemented. For example, the current global app marketing experience through the mainstream Google Play store is simply not available, and Android apps are distributed through a multiplicity of local alternative stores. This adaption results in very different channels, submission requirements, discoverability approaches, and user engagement from where Google Play has become the standard. China’s ecosystem is enriched by ‘super-apps’, or applications that encompass messaging, payments, mini-apps, and services, all in one app ecosystem.

The app marketing in this environment requires much more consideration of how the app can fit into or be positioned against these super-apps, which is a more holistic approach than purely thinking about install-campaigns, but rather how to drive the entire lifecycle of the app, when engagement is reliant on a potential partnership. Localisation becomes vital; language, cultural subtleties, user-expectation and monetisation models will change significantly in China. The result is, app marketing teams will have to look at China as somewhat of a separate ecosystem, but with unique stores, pathways for users and promotion levers.

Mature vs. Emerging Markets: Japan/Korea vs. India/SEA/Tier-2 Cities

Asia presents a diverse landscape of market maturity with direct implications for your app marketing strategy. In more mature markets like Japan and South Korea, smartphone adoption is high, users often expect premium experiences, and acquisition costs are higher. In these markets, App marketing in may involve branding, quality creatives, fostering deep engagement, and upscale or subscription models.

Conversely in developing markets like India, Southeast Asia and tier-2/3, the opportunity is often rapid scaling, more price sensitive users, lower CPIs, but lower ARPUs. App marketing in these markets relies on efficient performance tactics, extensive localisation (more languages) and ready for varying connectivity and hardware capabilities. Understanding which bucket your target market belongs to is a critical component to establishing an acquisition funnel, retention strategy, monetisation plans and creative localisation for app marketing success.

OEM App Stores, Telco Bundles and Pre-Installs in App Marketing

In addition to the traditional app-store experience, many Asian markets also offer further opportunities through OEM-specific app stores, telco-bundle apps and device pre-installs. These routes can provide meaningful incremental reach, and often with less competition and friction with discovery. For app marketing, this could mean engaging OEM partnerships or telecom operator partnerships, to negotiate app placements for pre-installs on the vareious devices.

However, these channels often differ in user intent and behaviour, pre-install users may show lower intent or retention than traditionally acquired users, so measurement, segmentation and creative flows must be adapted. Incorporating these alternative distribution mechanisms into a broader app marketing strategy can offer a competitive edge, especially in markets where CPI is rising or traditional channels saturate.

Cultural Nuance and Localization Strategy

The cultural diversity of the Asian market makes localized adaptation one of the most critical components of App Marketing in the region. The continent has hundreds of languages, long-standing historical traditions, and completely different digital behaviors, which all play a role in influencing how users discover, evaluate, and use apps. For App Marketing teams, this means that there is little chance that a single creative template or generic message will deliver strong marketing results across many countries. Strong returns tend to come from nuanced adaptation, local language choices, UI patterns, payment preferences, and cultural sensitivities that effectively resonate with specific audiences.

Because of the fragmentation of the user base across Asia, App Marketing needs to execute with precision. Every aspect, from colour symbolism to style of communication, will influence trust and conversion. Furthermore, economic cycles, religious holidays, and community events will frame the timing of App Marketing. Aligning campaign bursts, promotions, and creatives to local rhythms are essential to unlock installs and engage users beyond basic conversion.

Lastly, investing in community building, local support and brand proximity can lead to greater retention and advocacy. To summarize, App Marketing in Asia is not just about distribution, but about cultural integration, longer-term value and relevance.

Languages, Scripts, and UI/UX Localization for App Marketing

Asia has some of the most linguistically diverse mobile users on the planet, which makes language localisation crucial to acquire and retain users. More than basic translation, scripts such as Chinese characters, Japanese Kana, Thai script, and Arabic, have very specific and easily distinguishable UI changes to facilitate readability, spacing and/or visual balance. In addition to language scripts, people from different Asian markets gravitate toward distinct information architectures: either the need for dense information pages or very minimalistic styles.

Altering every detail, from the right-to-left text alignment and navigation, to region-specific iconography and colour choices, has an impact on user trust and conversion. If you are misaligned for the region, such as breaking text lines of vertical scripts or not properly rendering a font, you may experience high drop-off and reduced conversion rates in onboarding or app store traffic. This is also why localisation must extend into typography, inputs formats, date-style preferences, and microcopy for that region. When localisation is done properly, I feel like the UX was “built for me.” Which leads to not only a higher chance of install, but ultimately may lead to higher levels of engagement long-term.

Festivals, Seasonality, and Payday Patterns That Move Installs

Festivals and seasonal cycles impact mobile behaviour across Asia more than other regions in the world. Major instances such as Lunar New Year, Ramadan, Diwali, Golden Week, Singles Day, and end-of-year sales can cause a sudden rise in downloads and spending in-app. Running campaigns during case studies shows a significant difference in install rates, especially if creative takes on holiday themes or cultural references associated with these occasions.

Paydays mark influences on user acquisition and conversion costs. Frequent wages on a monthly or bi-monthly basis create a reliable frequency of spending power in these Asian markets. Conversion metrics for apps category in finance, shopping, travel, entertainment, food delivery, frequently improved and user acquisition and conversion costs should be focused on during these timeframes. Campaigns scheduled on paydays should be strategically planned, especially for more performance-driven user acquisition campaigns, and budgets should be optimised by bidding more on advertising inventory at non-payday schedules, for advertising when users transformed at high productivity.

Creative Culturalization: Visuals, Tone, and Trust Signals

Creatives generally determine whether users feel an app connects to their mindset and culture. Visual choices (e.g., clothing styles; tone of skin color; local architecture or symbols) enable users to see themselves in the product. Tone also varies significantly across markets—where some markets prefer direct, energetic, high-energy messaging, other markets prefer or expect that politeness is considered or sometimes formality with a sense of community.

Trust signals are particularly salient in Asia. Badges, rankings, user reviews, security messages to generate safety, cues about payment-security and affiliation with everyday, relatable micro-communities matter when it comes to adoption. Even small touches, like mobile number login, a specific logo in the payment solution cannot seem to invoke membership, or a familiar color palette can be the difference between a user that is hesitant to commit and one that converts cocurs. Culturalised creatives, every time, engage more reliably over genre tit commercials without cultural reference, creating less friction and amplified emotional resonance.

Local Support, SLA Levels of Expectations and Community Buuilding

Frequently, large audiences in Asian territories expect functioning customer support, local language communication, local response times, and levels of customer support. By providing FAQs specific to the region, chat support and service-level planning, a brand communicates to the user that their expectations of establishing credibility, in marketplaces face-paced tech cycles, local timezone, and community context matters, and it can create a template for minimising churn-reduce customer churn. In marketplaces with a local community considerations play a central role specific to any member’s decision to adopt or commit to usage, try initiating a local user group, or player ambassador program or expect local players to foster community locally at a city or micro-community level.

Additionally, many Asian markets place high value on social validation. Community events, loyalty programs, and user-generated content all enhance brand belonging. When users feel heard and supported, via culturally aware support teams and strong communication loops, they become more likely to stay active, engage deeply, and recommend the app to others.

Core Channels for User Acquisition in App Marketing

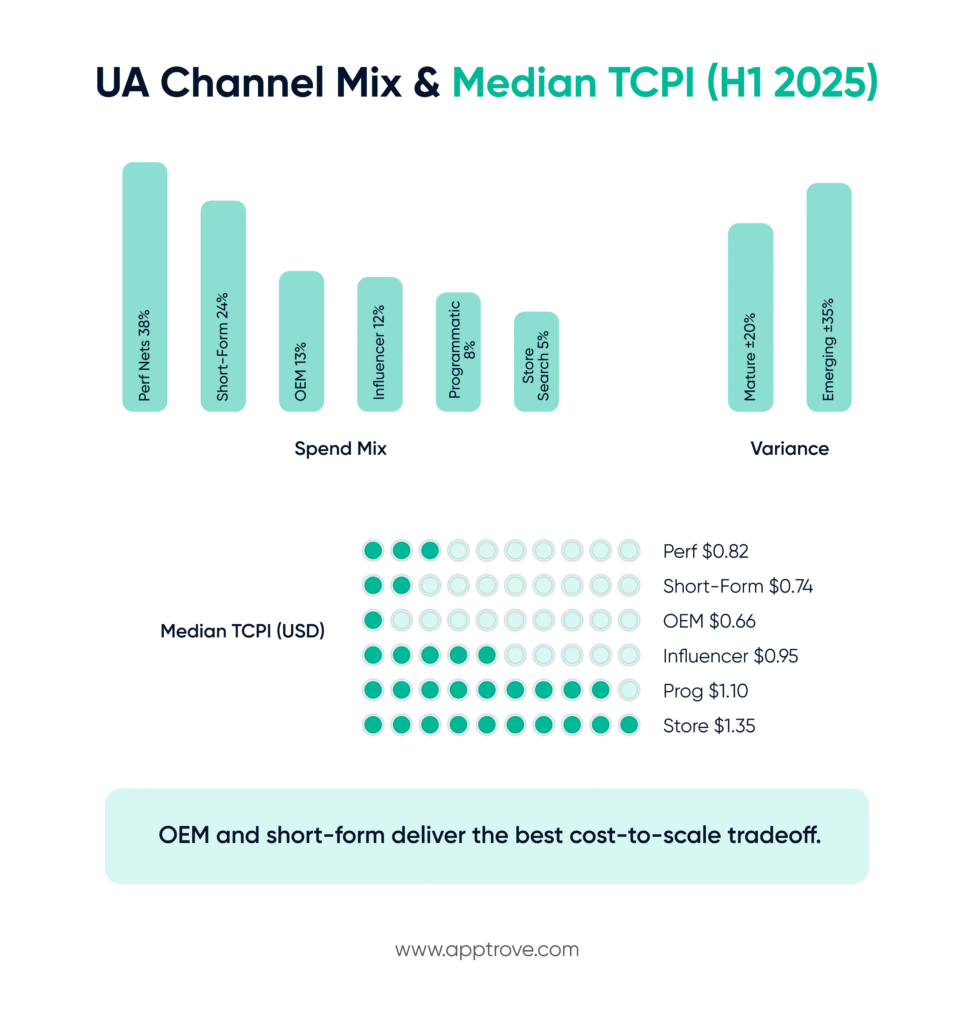

The user acquisition market in Asia is large, competitive, and dynamic. This requires brands to be knowledgeable about global platforms as well as region-specific opportunities. Given the diversity in mobile action, device ecosystems, and content consumption, Apps Marketing strategies must be channel agnostic, culturally competent, and performance-based. With increasing customer acquisition costs and fast-evolving user journeys, deciding what combination of paid, organic, and hybrid channels to deploy is now a core growth capability in-market. The most effective teams effectively combine large network media and specific local ecosystems, creators, original equipment manufacturers inventory, and conversion-focused infrastructures to turn impressions into installs and installs into long-lasting value.

Performance Networks: Meta, Google App Campaigns, TikTok, and Local Players

Performance networks are the continuing backbone of the user acquisition journey, as they offer predictable scale and measurable outcomes. Meta and TikTok are strong performers in interest-based targeting and creative-led targeting, while algorithmic campaigns offer broad scale and automated optimization. Local ad networks in Asia also drive impressive volumes of traffic which allow brands to capture audiences in specific and niche regional or language audiences. Strong creative iteration, accurate event tracking, and rapid experimentation cycles are essential to taking impressions to conversion efficiently.

OEM Inventory and On-Device App Marketing: Xiaomi, OPPO, vivo, Samsung

Device manufacturers have created robust yet often under-utilised inventories with pre-loaded feeds, native app stores, and in device placements. These surfaces appear in high visibility moments, like device set ups or system notifications, creating high install intent. Since OEM inventories usually have less competition than large networks, it becomes much more cost efficient – especially in emerging markets.

Influencer and Creator-Led App Marketing on YouTube, TikTok, Instagram, and Bilibili

Influencers create trust, cultural context, and contextual persuades. In a region defined by social consumption of content, niche or regional influencer endorsement will outperform generic ads. Authentic demos, challenge-

formats, and review-styled content expedite consideration through demonstrating real use cases that appeal to specific local markets.

Programmatic and DSPs – Brand to Install to Purchase Journey Programmatic buying allows you to target very specific cohorts (audiences) with tailored content subscriptions. DSPs allow the sequential storytelling and targeting of consumers from Awareness to Install to Purchase. The cost-effectiveness of this channel also allows breadth of buying and marginal bid price controls, frequency caps, segment creation and control over time. This channel works phenomenally well for app campaigns with a well-defined and decent sized audience of behavioural audience.

App Store Optimization (ASO) for App Marketing

App Store Optimization has emerged as one of the most fundamental pillars of mobile growth in Asia, especially as the competition increases and paid acquisition costs continue to rise. For brands that want to scale sustainably, ASO provides the building blocks of visibility, discoverability and conversion within the main app marketplaces. Given that user behaviour across the region is heavily search driven, app ranking for keywords, categories, and branded queries significantly informs both organic installs, and effectiveness of App Marketing campaigns that reach beyond ASO and are also running in parallel.Ultimately, ASO is more than a metadata exercise, it is a strategic lever that connects to creative testing, audience insights, and long-term retention programs.

In Asia’s multilingual environment, one of the most powerful tools available is keyword localisation. End users in markets such as Japan, Indonesia, Vietnam, Thailand and Korea will often search in native languages, and direct translation is not enough to elicit relevant results. The team must analyse search intent, cultural phrasing, and trending semantic patterns to build an appropriate keyword map that is locally relevant. High performing metadata combine a nuanced language, competitive benchmarking, and seasonal trends, to capture the widest aperture of user queries. Adopting a localised approach to ASO not only supports visibility, but directly supports the performance of App Marketing campaigns that may be running in parallel.

Equally important is creative optimisation. Icon design, screenshots, video previews, and feature Graphics play a large role in determining user conversion on a store page. Because visual preferences greatly vary across Asia, ranging from minimal layouts commonly found in Japan to more colorful, informative structures that are often seen in Southeast Asia, creative assets have to be customized to market-specific expectations. Different assets will perform better than others after continuous A/B testing in order to understand which messaging, value propositions, and visual cues drive the deepest resonance. These insights lead to improved conversion rates and lower costs for paid traffic, allowing App Marketing budgets to function at peak performance.

In addition to visuals and keywords, ASO includes ratings, reviews, category choice, and frequency of updates. Reputation signals can provide improved stability within your rank while frequent updates signal a trustworthy, quality product. These signals build trust, and credibility is imperative for your app to be competitive in verticals such as finance, commerce, and productivity. When executed consistently, ASO contributes to prioritizing overall visibility, improving trust among users, and advancing the effect of an even larger App Marketing strategy in the long run.

Paid UA Excellence in App Marketing

User acquisition (UA) using paid media has become one of the most mature, data-driven, and refined growth engines in Asia, particularly as mobile competition heats up and users become more fragmented across devices, platforms, and content types. Teams seeking true excellence in UA should strive for a balanced blend of performance discipline, creative thinking, and solid cultural context. In many cases, paid and organic channels are intertwined. In this environment, solid UA execution will drive installs and ultimately improve rankings, visibility in stores, and engagement metrics downstream that improve a wider system of App Marketing.

For a paid UA strategy to be successful, the foundation should be a segmented audience. Privacy changes will continue to affect the way teams find and execute paid campaigns, so teams must rely more heavily on first-party data, behavioral modeling, and test cases to guide bid strategy and audience targeting. Algorithms can process more data, but their best performance will always come from high-quality signals, either conversion based, retention based, or predictive modalities designed to maximize future value based on other signals and inputs. Combining machine-based optimization and insights for humans provides a balanced approach to align cost with sustainability over the long term. This supply line helps ensure ambitious campaign objectives are tied to broader brand and performance objectives, rather than being reactive to appease a vanity railment.

Currently, creativity is also essential. Markets across Asia consume visual content at a staggering rate and performance creatives must evolve quickly, innovate in cultural context, and adapt to platform-specific audiences. Rapid creative iteration and testing formats, such as UGC-style videos, storytelling through narrative hooks, and regionally relevant messaging, can multiply click-through rates and drastically lower cost per install. Strong creative frameworks also elevate acquisition performance, but they also amplify the storytelling foundation of App Marketing across channels.

Measurement excellence is the last pillar of paid growth. Teams need to implement methodologies to monitor both the immediate install performance and lifetime value, using cohort analysis, incrementality tests, and multi-touch attribution models when possible. This enables paid budgets to focus on high-quality users that contribute to sustainable growth. If executed effectively, paid user acquisition can be much more than a channel and can serve as a growth engine for retention, influence product roadmaps, and enhance the overall scope of App Marketing within an organization.

Conclusion and Executive Takeaways for App Marketing

Asia possesses one of the most vibrant and diverse mobile ecosystems in the world. It’s critical for brands to approach growth with precision, adaptation, and cultural intelligence. Success in the region demands more than a high-level, overall approach; it requires enhanced localisation, intelligent channel selection, and long-term value creation. As acquisition costs rise, and user expectations deepen, team alignment must evolve so that each part of the funnel assists in driving sustainable, cost-efficient outcomes. Strategic discipline, market understanding, and cross-departmental alignment are critical characteristics of best-in-class App Marketing organisations. If executed well, the combination of these drivers not only drives installs, it creates a defensible competitive advantage which strengthens over time.

The Playbook: Acquire Efficiently, Retain Deeply, Monetize Locally

A successful approach for Asia can be articulated in three pillars: 1) acquire efficiently through smart bidding, creative iteration and channel balance so every dollar spent maximises impact; 2) retain deeply with personalisation for onboarding, contextual messaging and optimised lifecycle flows to dampen churn; and 3) monetisation, aligned with local needs whether subscription, micropayment, reward based or hybrid match regional purchasing behaviours with the product. These three pillars enable teams to establish a cohesive system that enables App Marketing to drive revenue, product

Country-By-Country Must-Do Checklist

As there is no similar behavior across Asian markets, a tailored country strategy is essential to success for your users and business. For example, markets with high ARPU such as Japan and Korea need developed creative and strong reputation signals from a premium position. Whereas growth markets like India or Indonesia need lightweight experiences, multilingual campaigns and messaging focused on value. China creates a different situation with the requirement for compliance more time and options for alternative app stores and ecosystem integration. Southeast Asia’s cultural diversity entails the need for language adaption and planning your marketing efforts around festivals is key. These insights will ensure your App Marketing strategy is relevant, efficient and responsive to the unique market’s needs.

Final recommendations and next steps

To continue to advance in the region, teams should develop measurement maturity, new creative scalability and strategy planning from local knowledge. Working with regional creators /OEM channels while ensuring more programmatic opportunities can only help get the exposure. Furthermore, you should always be testing and iterative improving that via AB testing or usability tools. Continued engagement across teams of Marketing, Product, Data and Operations will keep the user journey as seamless as possible. Next up for App Marketing effectiveness will be a blend of analytics, cultural nuance and adapting as you go for growth across Asia long term.