Mobile ad fraud refers to any deceptive or fraudulent activity that generates false or invalid clicks, installs, or engagements on mobile advertising campaigns. This type of fraud can have significant negative effects on both advertisers and publishers in the mobile advertising ecosystem.

As these technologies evolve, cybercriminals will be able to produce increasingly convincing fraudulent impressions, clicks, and installs, making it more challenging for businesses to identify and stop fraud.

In this article, we will talk about the different types of mobile ad fraud and find out ways for mobile fraud prevention.

Introduction

Mobile ad fraud refers to fraudulent or deceptive activities that aim to generate illegitimate mobile advertising revenue or to manipulate mobile advertising data.

This type of mobile fraud can take many forms, such as the use of bots or other automated tools to simulate ad clicks, app installs, or other types of mobile advertising events. It can also involve the use of fake or incentivized user accounts to generate fraudulent impressions or clicks.

Mobile ad fraud can have serious consequences for advertisers, who may end up paying for ad placements that are never seen by real users or for clicks that are not genuine.

For example: Let’s say you are a marketer and you have decided to run a mobile advertising campaign for your app. However, one of the publishers in the network is engaged in mobile ad fraud. They use automated scripts or bots to simulate clicks on your ads, which leads to false installations of your app. This publisher can earn money by receiving a commission for the false installs that they generate.

As a result, you end up paying for installations that are not genuine, and your campaign results in lower ROI. Such fraudulent activities result in mobile ad fraud.

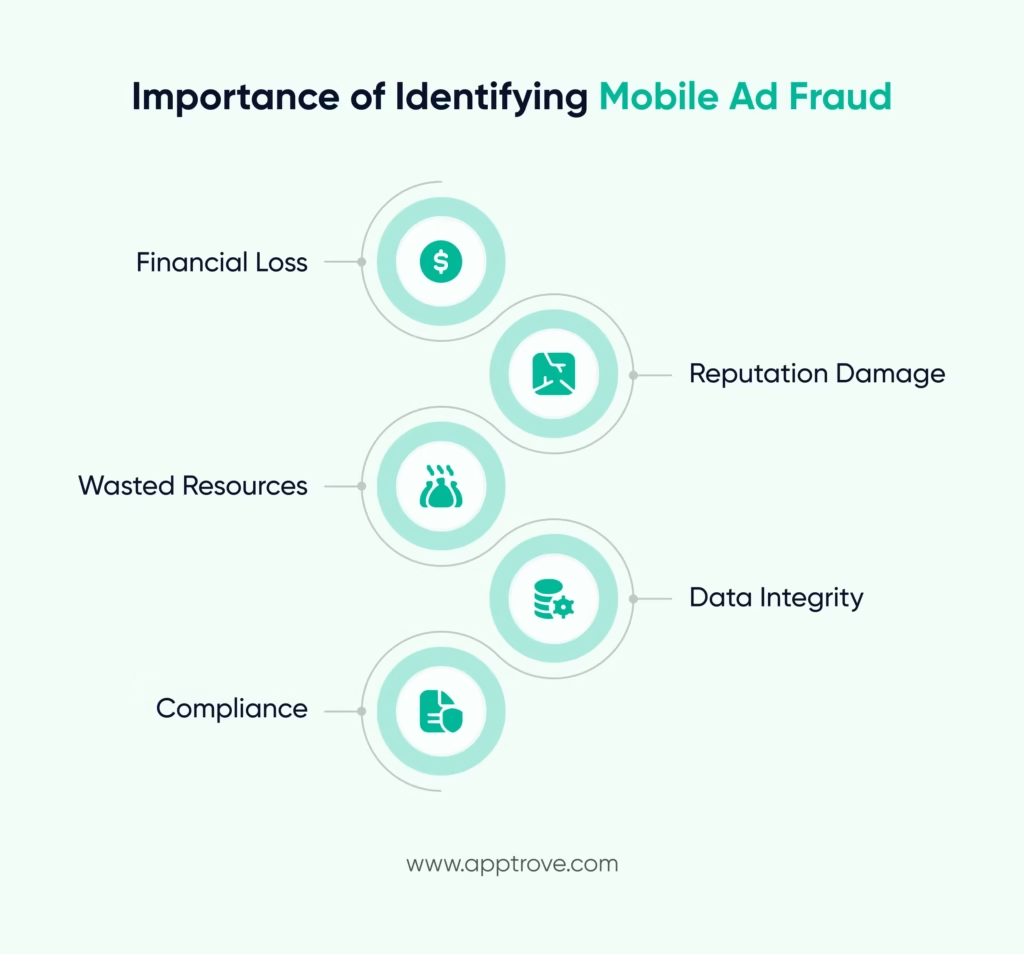

Importance of Identifying Mobile Ad Fraud

Identifying mobile ad fraud is important both for businesses and advertisers as early as possible. Here’s why mobile ad fraud should be identified soon.

Financial Loss:

Ad fraud results in huge financial losses and is estimated to cost businesses billions of dollars each year. If mobile ad fraud goes undetected, it can lead to significant financial losses for advertisers, publishers, and other stakeholders.

Reputation Damage:

Mobile ad fraud can damage the reputation of advertisers, publishers, and ad networks. Advertisers can lose credibility with their audience, while publishers and ad networks may suffer reputational damage if their ads are associated with fraudulent activity.

Wasted Resources:

Ad fraud can result in wasted resources as advertisers and publishers invest in ads that are never seen by real people. This can lead to inefficient spending and lost opportunities.

Data Integrity:

Mobile ad fraud can also compromise the integrity of data collected through advertising campaigns. This can result in inaccurate metrics, which can make it difficult to measure the success of a campaign and optimize for better results. There’s been a constant increase in fraudulent activities and fake traffics.

Compliance:

Ad fraud is not only financially damaging, but it can also result in legal and compliance issues for advertisers and publishers. Many countries have laws and regulations that prohibit ad fraud, and non-compliance can result in fines and other penalties.

Hence, identifying mobile ad fraud is crucial for protecting businesses’ financial interests, preserving reputation, optimizing ad campaigns, and complying with legal and regulatory requirements.

Types of Mobile Ad Fraud

What is Click Fraud?

Click fraud is a fraudulent activity that involves clicking on pay-per-click (PPC) ads for the sole purpose of increasing the advertiser’s cost without any intention of actually making a purchase or showing interest in the campaign.

Click fraud is often carried out by competitors of the advertiser, malicious bots, or individuals looking to earn money from ad clicks. These fraudsters use automated scripts or software programs to repeatedly click on the ads, driving up the advertiser’s costs and wasting their advertising budget.

There are various types of click fraud, including:

- Bot Clicks: This type of fraud involves bots or software programs that are designed to click on ads automatically. These bots are usually controlled by a hacker or an individual who wants to generate ad revenue.

- Manual Clicks: Manual click fraud is carried out by individuals who manually click on ads to increase the advertiser’s costs. These individuals are usually hired by competitors of the advertiser or by fraudsters who want to earn money from ad clicks.

- Click Farms: Click farms are operations where large groups of people are hired to click on ads. These people are usually located in countries where labor is cheap, and they are paid a small amount of money to click on ads repeatedly.

Click fraud can have serious consequences for advertisers. It can lead to a significant increase in advertising costs, resulting in a waste of resources and budget. It can also reduce the effectiveness of the advertising campaign, as the advertiser is paying for clicks that are not generating any actual sales or leads.

How to prevent Click Fraud?

To prevent click fraud, advertisers can take several measures. They can use fraud detection software that can help identify fraudulent clicks and block them from their campaigns. They can also monitor their ad campaigns regularly to detect any unusual activity, such as a sudden increase in clicks or a high number of clicks from a single IP address.

Hence, click fraud is a serious problem that affects the digital advertising industry. It can lead to significant financial losses for advertisers and can reduce the effectiveness of their campaigns. It is important to be aware of click fraud and take steps to protect your advertising budget from this fraudulent activity.

What is Attribution Fraud?

Attribution fraud is a type of fraudulent activity that occurs when a publisher takes credit for an action or conversion that was actually not generated by him. This type of fraud can occur in various contexts, such as affiliate marketing, advertising, and online marketplaces.

For Instance, In affiliate marketing, attribution fraud occurs when an affiliate falsely claims credit for a sale or conversion that was actually generated by another affiliate, or through direct traffic to the advertiser’s website. This can result in the fraudulent affiliate receiving a commission or payout that they do not deserve.

In advertising, attribution fraud can occur when a publisher falsely claims credit for a click or impression that was actually generated by a bot or other fraudulent means. This can result in the advertiser paying for fraudulent traffic that does not result in any genuine user engagement.

There are various techniques that fraudulent parties can use to perpetrate attribution fraud, such as cookie stuffing, click injection, and mobile app install fraud.

“Cookie stuffing involves inserting a tracking cookie into a user’s browser without their knowledge or consent, in order to falsely attribute a sale or conversion to a particular affiliate.”

“Click injection involves sending a large number of clicks to an advertiser’s website just before a legitimate user clicks on an ad, in order to falsely claim credit for the user’s action.”

Attribution fraud can have serious consequences for legitimate parties, including lost revenue and damage to reputation. To prevent attribution fraud, it is important for advertisers, affiliates, and online marketplaces to implement effective fraud detection and prevention measures, such as monitoring traffic quality, analyzing user behavior, and using advanced fraud detection software.

By understanding the techniques used by fraudulent parties and implementing effective fraud detection and prevention measures, legitimate parties can protect themselves against this type of fraud and ensure a fair and transparent marketplace.

What is Install Fraud?

Install fraud, also known as mobile app install fraud, is a type of fraud that occurs in the mobile advertising industry. It involves the manipulation of mobile app installs data by fraudsters, in order to receive payment for fraudulent installs that never actually occurred.

The mobile app advertising industry is a highly competitive and lucrative market, with billions of dollars spent annually on user acquisition campaigns. Advertisers pay app developers and mobile ad networks for each user who installs their app after clicking on an ad. However, fraudsters have found ways to exploit this system by using automated scripts, bots, and other tactics to simulate app installs and generate revenue through fraudulent means.

There are several types of install fraud that can occur in the mobile app advertising industry.

- Click Spamming: Click spamming, where fraudsters generate a large volume of fraudulent clicks on an ad in order to increase the chances of a fake install being attributed to their account.

- Install Farms: Install farms, where fraudsters use networks of devices or virtual machines to simulate real app installs.

Install fraud can have significant financial consequences for advertisers and app developers, as they may end up paying for installs that do not result in any actual revenue or engagement. In addition, install fraud can damage the reputation of the business as a whole, leading to a lack of trust between advertisers and ad networks.

To prevent install fraud, advertisers and app developers can implement various measures such as:

- Fraud detection software

- Third-party verification services

- Strict monitoring of user acquisition campaigns

It’s important to work with reputable ad networks and partners and to remain vigilant against potential instances of fraud.

What is In-app Fraud?

In-app fraud refers to fraudulent activities that take place within a mobile app. This can include fake app downloads, fake purchases, deceitful ad clicks, and other similar activities. In-app fraud is becoming more sophisticated and harder to detect, making it a significant threat to the security of mobile apps.

Common types of in-app fraud are:

- Ad fraud: Ad fraud involves creating fake clicks or impressions on ads, which can result in advertisers paying for fraudulent views or clicks. This can be achieved by using bots, scripts, or other automated methods to generate fake clicks or impressions.

- App spoofing: This involves creating fake apps that mimic popular apps to trick users into downloading and using them. Once the user has downloaded the fake app, the fraudsters can steal sensitive information such as passwords, credit card details, and other personal information.

In-app fraud can also occur in the form of fake purchases. This involves fraudsters using stolen credit card information to make purchases within an app. This type of fraud is particularly damaging to app developers, as they are often liable for chargebacks and refunds.

To prevent in-app fraud, app developers need to take a proactive approach to security. This can involve implementing security measures such as:

- Multi-factor authentication

- Encryption

- Fraud detection systems.

In conclusion, in-app fraud is a growing concern for both consumers and app developers. App developers need to implement robust security measures to protect their users and prevent fraudulent activities.

Signs of Mobile Ad Fraud

- High click-through rate (CTR): If your ad campaigns are generating unusually high CTRs, it could be a sign of click fraud. This occurs when fraudsters create fake clicks on ads in order to inflate the number of clicks and generate revenue.

- Low Conversion Rate: If your ads are generating a high number of clicks but few actual conversions or purchases, it could be a sign of fraud. This could indicate that bots or other automated systems are clicking on your ads, rather than real human users.

- Abnormal user behavior: If you notice a high percentage of clicks coming from the same device, it could be a sign of fraud. Fraudsters often use bots or scripts to generate a large number of clicks from a single device.

- Unusual Traffic Sources: If there is a high percentage of clicks coming from unusual or unexpected traffic sources, it could be a sign of fraud. Fraudsters often use proxy servers or other techniques to generate clicks from non-human sources.

- Rapidly Spiking Metrics: If you notice a sudden spike in clicks or installs that cannot be attributed to any specific marketing activity or campaign, it could be a sign of fraud. Fraudsters often use burst campaigns to generate a large number of clicks in a short period of time in order to generate revenue before they are caught

Apptrove Anti-Fraud Tool

Apptrove anti-fraud tool is designed to help businesses and organizations detect, prevent, and mitigate fraudulent activities. Apptrove uses advanced analytics, reporting formats, and other technologies to analyze large volumes of data, identify patterns and anomalies, and detect potentially fraudulent behavior in real-time. Here are some of the key features and capabilities it has.

- Fraud detection: It uses advanced analytics to detect payment fraud, account takeover, identity theft, and more. They analyze data from various sources, such as transactions, customer behavior, and device information, to identify potential fraud indicators.

- Real-time monitoring: Apptrove monitors transactions and user behavior in real-time, allowing them to detect and block fraudulent activities as they occur.

- Rule-based models: It uses rule-based models that follow a set of predefined rules to identify fraud.

Overall, Apptrove’s fraud prevention platforms play a crucial role in helping businesses protect themselves and their customers from such fraud. By using advanced analytics our platform can detect and prevent fraud in real time, reducing financial losses and reputational damage.

Anti-Fraud SDKs

Anti-fraud SDKs (Software Development Kits) are tools that developers can integrate into their applications to help detect and prevent fraudulent activity. These SDKs typically provide a range of features and capabilities, such as:

- Device fingerprinting: Anti-fraud SDKs can capture device-specific data such as device ID, OS version, and IP address to identify unique devices and detect suspicious behavior.

- User behavior analytics: These SDKs can analyze user behavior patterns and detect anomalies or deviations that may indicate fraudulent activity.

- Real-time risk assessment: Some anti-fraud SDKs use machine learning algorithms to assess the risk of a transaction or activity in real-time and flag potentially fraudulent transactions.

- Blacklisting: Anti-fraud SDKs can maintain a blacklist of known fraudulent users, devices, or activities and prevent them from accessing the application.

- Two-factor authentication: Some SDKs provide additional layers of security such as two-factor authentication, which requires users to provide a second form of authentication in addition to a password.

These SDKs can help businesses reduce the risk of fraud and protect their customers’ data and assets.

Conclusion

Detecting and preventing mobile ad fraud is necessary. As it helps advertisers to ensure that they are getting the maximum return on their investment in mobile advertising campaigns. Preventing mobile ad fraud also helps to maintain the integrity and trust of the mobile advertising ecosystem.

It can also harm the user experience. Fraudulent ads may lead to unwanted or unexpected redirects, pop-ups, or other unwanted behavior, which can damage the user experience and harm the reputation of legitimate advertisers.

To detect and prevent mobile ad fraud, various techniques such as fraud detection algorithms, device fingerprinting, and manual review can be employed. It is important for advertisers and publishers to stay informed about the latest fraud tactics and prevention strategies and to work with trusted partners who prioritize fraud prevention. By taking proactive steps to detect and prevent mobile ad fraud, the mobile advertising ecosystem and affiliate industry can continue to thrive and deliver value to both advertisers and users.

FAQs

1. What is mobile ad fraud and why is ad fraud prevention important?

Mobile ad fraud encompasses dishonest practices such as fake clicks, installs, or impressions, which undermine advertising budgets without producing real user interactions. Effective ad fraud protection helps defend the return on investment (ROI), uphold campaign integrity, and protect the advertiser’s brand reputation.

2. What are the most common types of mobile ad fraud?

The most frequent multiple instances are click fraud, attribution fraud, install fraud, and in-app fraud. Each type entails manipulating data or user activities to create financial gain. Using advanced ad fraud prevention solutions such as Apptrove, advertisers can discover anomalies in real-time and block fraudulent activity.

3. How does ad fraud prevention improve ROI for mobile marketers?

Preventing ad fraud guarantees that marketing budgets are only spent on authentic impressions, installs and clicks. The filtering process of questionable activity allows marketers to acquire precise performance data, enhance campaigns properly and obtain better revenue returns on ad spend.

4. What technologies are used in ad fraud prevention tools?

Contemporary approaches to combatting ad fraud rely on device fingerprinting, machine learning algorithms, real-time monitoring, and user behavior analytics. One such platform, Apptrove incorporates these methodologies to provide anomaly detection in real-time, enabling organizations to reduce risk of fraud before it impacts the performance of their campaigns

5. How can businesses integrate ad fraud prevention into their marketing strategy?

Businesses can incorporate ad fraud prevention by utilizing reputable anti-fraud SDKs, collaborating with validated ad networks, and deploying real-time fraud detection technology. Solutions such as Apptrove make this process simpler by providing rule-based models, blocking, and behavioral analytics to protect the campaign from fraud.