Did you know global financial services app downloads jumped from 4.6B in 2020 to a projected 7.7B in 2024? Consumer behavior in the financial sector has changed significantly with the rise of mobile-first interactions. Whether it’s applying for a loan, investing in stocks, or managing daily expenses, consumers now prefer mobile apps over physical branches or financial advisors as their primary point of contact.

From customer acquisition to engagement and conversion, the right financial services digital marketing approach can help fintech brands differentiate themselves in a saturated market. As a leading mobile marketing and attribution platform, Apptrove ensures that financial brands maximize their reach, optimize campaigns, and measure success through its advanced analytics, deep linking, and fraud prevention. Whether you’re a fintech startup, an established banking institution, or a digital-first lending company, the right digital marketing strategies, powered by Apptrove, can completely change the way you acquire, engage, and retain customers and set you apart from your competitors.

Why Financial Services Digital Marketing is a Must-Have for Your Business?

With mobile-first users, cashless transactions, and tech-driven banking, businesses can no longer rely on traditional marketing methods alone. Consumers now expect not just functional financial apps but seamless, secure, and hyper-personalized experiences at their fingertips.

The success of fintech apps is defined by their ability to acquire and retain high-value users in a space governed by trust, regulatory constraints, and changing consumer behavior. These apps compete in an attention economy where every second of friction leads to user drop-off. Financial services digital marketing helps in building trust, engaging audiences, and improving customer retention. Unlike traditional marketing, digital strategies allow companies to reach their target audience with personalized, data-driven campaigns directly. Some of the key benefits include:

- Expand Your Reach: Traditional marketing methods have limitations, but financial services digital marketing allows providers to reach a global audience and target specific customer segments effectively.

- Enhance Customer Trust: A well-structured content marketing strategy educates customers, helping them make informed decisions while positioning your brand as an industry leader. Transparency and credibility are important to build the trust of customers.

- Improve Lead Generation & Conversion: Using search engine optimization (SEO), social media marketing, and paid advertising ensures you attract high-intent customers who are actively searching for financial solutions.

- Offer a Seamless Customer Experience: By using marketing automation, chatbots, and AI-powered insights, financial brands can provide a personalized experience across multiple touchpoints, from social media to mobile apps.

- Increase Brand Awareness & Retention: Consistently engaging your audience through valuable content, educational webinars, and interactive social media campaigns keeps your brand top-of-mind.

How is Digital Marketing Shaping the Financial Services Industry?

The financial sector has historically been slow to adopt digital marketing due to regulatory concerns and legacy systems. However, recent advancements have reshaped the industry, making digital marketing indispensable for financial firms.

1. The Shift Towards Mobile-First Banking

With over 80% of consumers using mobile apps for financial transactions, optimizing mobile experiences is extremely important to ensure their websites, apps, and marketing campaigns are mobile-friendly and integrated with social media and payment platforms. Unilink offers smooth, uninterrupted customer journeys, from ad clicks to app installs to transaction completions.

BankSathi, a company committed to making financial products accessible, needed a complete marketing analytics solution to optimize campaigns and reduce acquisition costs. Apptrove empowered them to track performance with precision, leading to a 46.34% reduction in campaign costs and a 400% increase in clicks.

2. Hyper- Personalization in Fintech

Consumers expect personalized financial advice and tailored product recommendations. With advanced audience segmentation, financial brands can analyze consumer behavior and create hyper-personalized marketing campaigns that improve engagement and increase retention.

3. The Rise of BNPL (Buy Now, Pay Later) & Digital Lending

BNPL services have transformed how customers approach credit. Financial marketers must target the right audience with strategic advertising and personalized offers. Apptrove enables BNPL providers to optimize their customer acquisition and retention efforts by tracking user behavior, segment audiences, and measure engagement.

4. Regulatory Compliance & Data Privacy Challenges

One of the biggest challenges in financial services digital marketing is ensuring compliance with regulations such as GDPR, CCPA, and RBI guidelines. Transparent communication about data security and privacy builds trust and reassures customers that their financial information is safe. This complexity makes compliant and data-driven mobile measurement partners like Apptrove more essential than ever.

Tips for Financial Services Digital Marketing

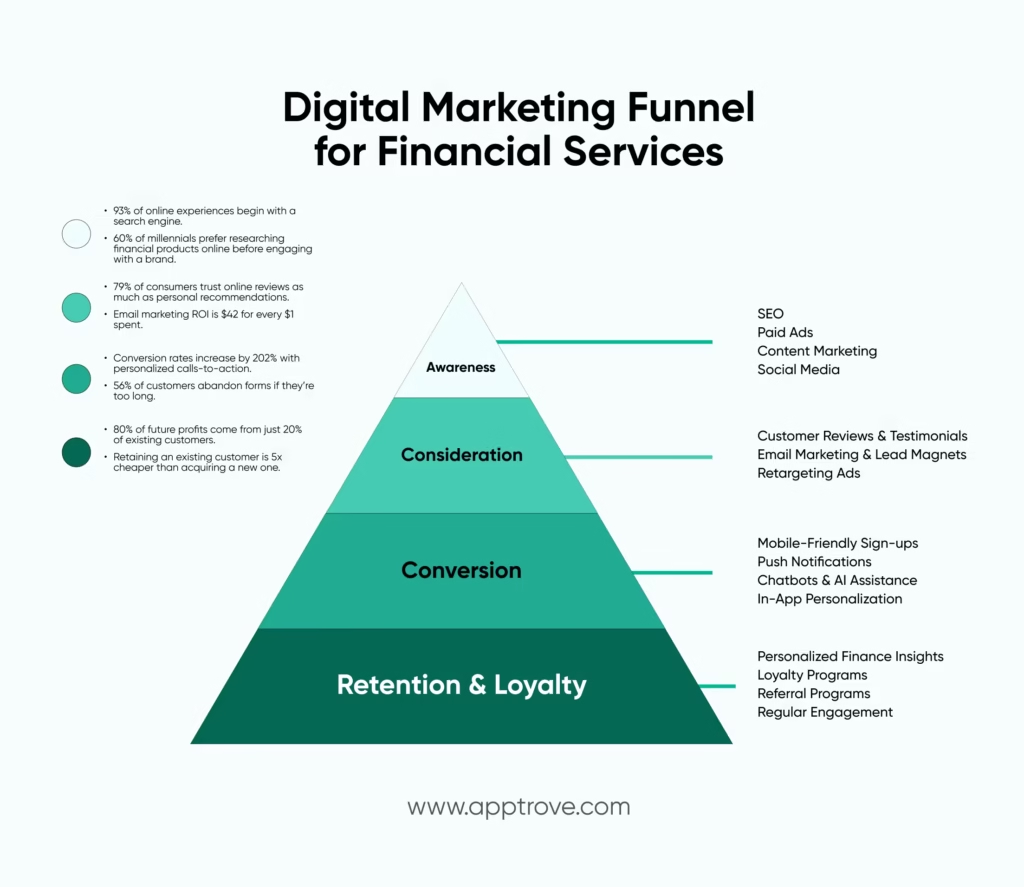

A successful financial services digital marketing strategy goes beyond just running ads. It requires a well-rounded approach that prioritizes education, engagement, and trust. Here are key digital marketing strategies for financial brands:

1. Invest in SEO to Improve Organic Visibility

Search engine optimization (SEO) is important for financial brands to improve their online presence. Financial services providers need to appear in search results when potential clients are looking for solutions. A strong SEO strategy involves:

- Targeting high-intent and trending keywords related to the industry.

- Creating SEO-optimized blog posts, guides, and case studies that answer user queries and build domain authority.

- Optimizing for local SEO to attract customers searching for nearby financial services.

2. Engage Audience Through Content Marketing

Content marketing is one of the most powerful tools in financial services digital marketing strategy. Engaging and informative content helps establish your brand as a thought leader. Effective content marketing ideas include:

- Financial Literacy Blogs & Guides: Educate consumers on financial planning, investment strategies, and credit management.

- Webinars & Podcasts: Host live sessions with industry experts to answer common financial questions and explain complex financial topics in an easy-to-understand manner.

- Case Studies & Success Stories: Showcase how your financial products have helped businesses and individuals succeed, and establish industry authority.

3. Prioritize Mobile App Marketing

With financial transactions shifting to mobile, app marketing is of utmost importance for customer acquisition. Strategies include:

- App Store Optimization (ASO): Optimizing app descriptions, keywords, and visuals to improve downloads.

- Push Notifications: Sending personalized alerts about promotions, investment trends, or loan approvals.

- Deep Linking Technology: Seamlessly connecting users from emails or ads to specific app pages using solutions like Apptrove’s Unilink.

4. Fraud-Free Paid Campaigns

While organic marketing is important, paid advertising does wonders for customer acquisition. However, financial services often face high ad fraud rates. Fraudulent installs were a major concern for GroMo, which connects over 14 lakh partners with financial products. Using Apptrove’s 7-layer fraud detection system, they saw a 42% decrease in fraudulent installs and a 238% increase in genuine user acquisition.

With the right fraud detection and prevention, financial brands should use:

- Google Ads & PPC Campaigns: Target customers searching for financial solutions.

- Social Media Ads: Run retargeting campaigns to convert users who have interacted with your content.

- Native Advertising: Partner with reputable finance blogs and news platforms for sponsored content placements.

The Future of Financial Services Digital Marketing

As technology advances, financial services digital marketing will continue its transformation, and if you’re not adapting, you’re falling behind. Here’s what you need to know to dominate the financial services space in 2025 and beyond.

- Voice Search Optimization: More people are using voice assistants like Alexa and Siri for banking needs. Financial brands must adapt by using conversational keywords and optimizing content for voice search.

- Blockchain & Crypto Marketing: With cryptocurrencies and blockchain technology gaining traction, financial marketers must focus on clear, educational content while staying compliant with regulations.

- Hyper-Personalization: AI-driven insights now allow financial brands to deliver highly customized experiences. By analyzing real-time user behavior, businesses can offer relevant product recommendations, improving customer engagement.

- Metaverse Banking: The rise of virtual spaces means financial institutions may soon offer services in the metaverse. From virtual branches to immersive financial education, digital banking is set to become more interactive than ever.

Summing Up

The game is changing, and it’s changing fast. Those who cling to outdated marketing tactics will soon find themselves watching from the sidelines as AI-driven personalization, crypto marketing, and voice search redefine how financial brands connect with their audience.

While these new technologies present fresh opportunities, they must be adopted wisely. Marketers must balance innovation with reliability, ensuring that each advancement serves the real purpose, which is to enhance customer experience, build long-term relationships, and drive measurable growth.

Because in the end, financial services digital marketing isn’t about algorithms or data points, it’s about trust. And trust is built by those who stay ahead.

Frequently Asked Questions

What is financial services digital marketing?

Financial services digital marketing refers to online strategies that banks, fintechs, insurance companies, and lenders use to connect with customers. It includes SEO, paid ads, content marketing, mobile app campaigns, and social media engagement to acquire, retain, and build trust with users.

Why is digital marketing important in the financial sector?

The financial sector is highly competitive and regulated. With consumers moving to mobile-first banking, digital marketing helps financial brands stay relevant, reach the right audience, reduce acquisition costs, and build long-term relationships with customers.

What role does fraud prevention play in financial services marketing?

Ad fraud is a major challenge for financial brands. Without fraud prevention, marketing spend often gets wasted on fake installs or low-quality traffic. Apptrove’s 7-layer fraud detection system protects ad budgets while ensuring campaigns reach genuine users.

Which digital marketing channels work best for financial services?

Some of the most effective channels include:

– SEO for long-term visibility

– Paid search ads for high-intent conversions

– Social media for engagement and retargeting

– Content marketing to build trust

– Mobile app marketing with deep linking for seamless journeys

How can Apptrove help financial brands improve digital marketing?

Apptrove enables financial services providers to maximize ROI through advanced analytics, deep linking, fraud prevention, and campaign optimization. By tracking user behavior and attribution, Apptrove helps financial brands acquire quality users, improve retention, and cut costs.