Are you aware that more than two-thirds (68%) of smartphone owners have made a purchase using a mobile device in 2024? (Source: Statista) As online sales on mobile devices are rapidly growing, mobile banking apps now need to be a requirement versus an option. Creating an effective advertising strategy, for both attracting new customers and retaining existing users, is arguably one of the biggest challenges facing companies that choose to advertise their mobile banking apps.

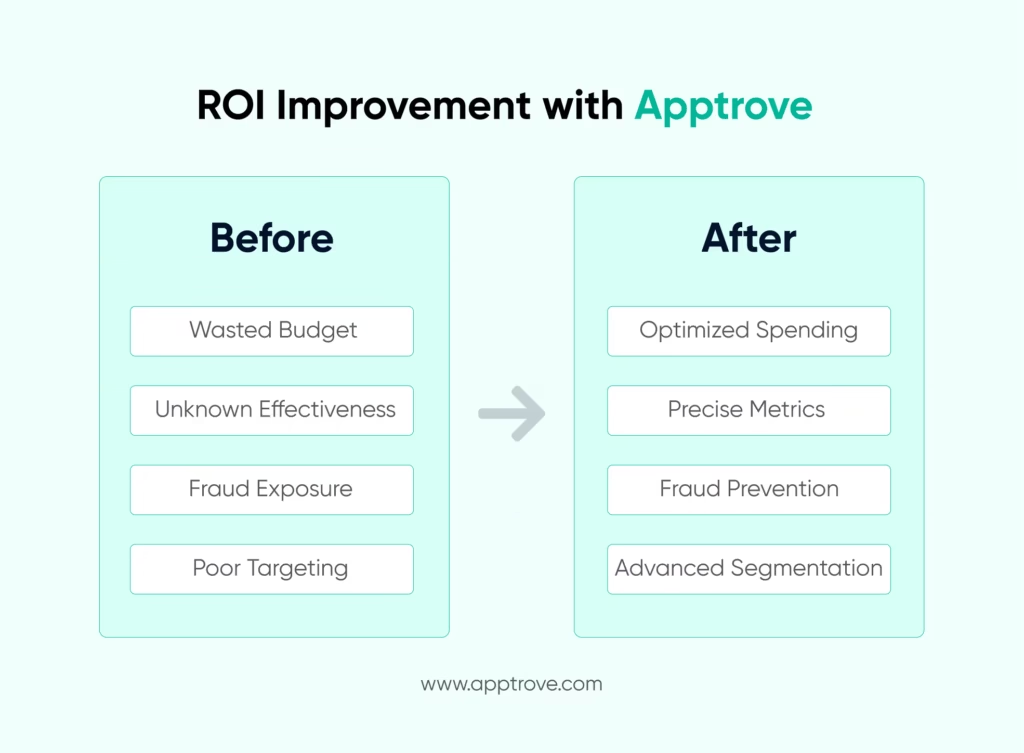

Creating a successful marketing campaign for your mobile banking app is also difficult, primarily due to the fact that most mobile banks have a difficult time targeting prospective end-users as well as completing accurate attribution and efficient allocation of advertising dollars. These same challenges are also faced by many business owners who operate a mobile banking app in conjunction with the marketing departments. This is where Apptrove can help! As an MMP, Apptrove allows companies to create better advertising results through accurate attribution of users, fraud prevention, and audience segmentation to achieve the maximum ROI.

Why Mobile Banking App Advertising Matters?

The advent of mobile banking can be attributed to the rise in digital banking usage, which is forcing financial institutions to progress beyond their normal efforts in providing banking through conventional means. Most consumers now prefer to utilize mobile or online solutions for their everyday banking needs instead of visiting brick-and-mortar branches. With the majority over 67% preferring a mobile banking solution to visiting a bank branch, advertising strategies towards building brand awareness of mobile banking applications face four main barriers, even though market demand is apparent.

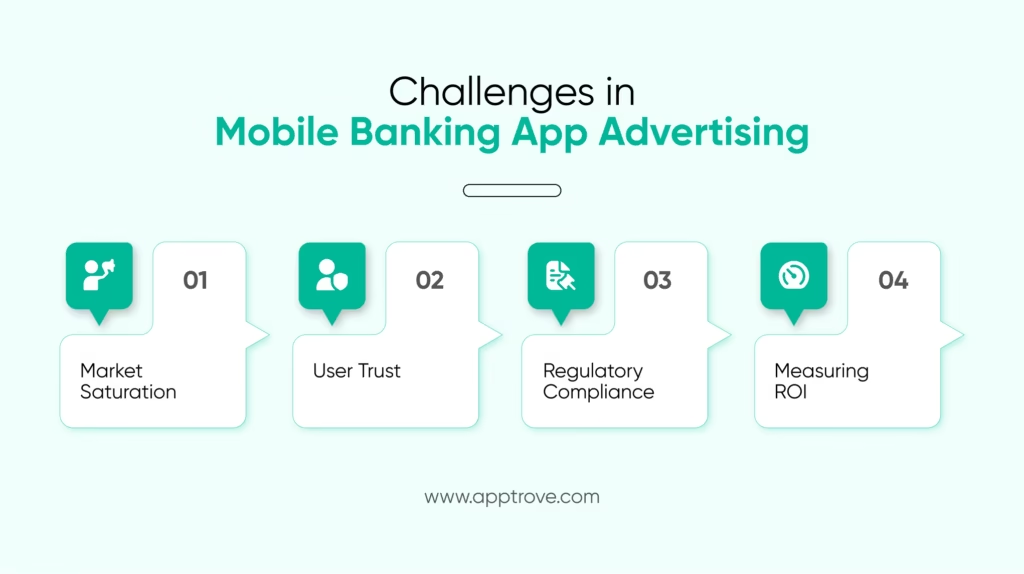

Challenges in Mobile Banking App Advertising

1. Market Saturation: New and existing applications will struggle to find their place in app stores or marketplaces because there are an overwhelming number of competing applications on the market.

2. User Trust: Security is critical in mobile banking because of the personal information required from users, so the creation of a brand involves the need to engender and maintain user trust through effective customer service in order to attract and retain users.

3. Regulatory Compliance: Financial institutions have strict regulations to adhere to in regards to the advertising methods they can use and/or limitations in regards to the distribution channels they can use.

4. Measuring ROI: Without the correct performance measurement tools, evaluating the effectiveness of mobile banking advertising campaigns and evaluating the return on investment (ROI) associated with each mobile banking customer acquisition will be complicated.

Winning Strategies for Mobile Banking App Advertising

1. Discover Advanced Methods for Increasing Your Reach with Contextual Targeting

If you want your advertisements to be seen by the right people and use their behaviours and interests in the ads, you need to use contextual targeting as part of your advertisement strategy. With the ability to use Apptrove to monitor audience segmentation and analytics, you can effectively deliver advertisements related to mobile banking services to users who are demonstrating interest in these services, both through their digital behaviour and also in the apps they use.

2. Use Deep Linking to Provide a Smooth, Seamless Conversion Experience

Many apps, particularly apps associated with the banking industry, have problems with their time to complete the sign-up process because users have difficulty navigating from an advertisement after clicking on the ad for the app. The use of deep linking within the Apptrove platform allows you to navigate easily within a mobile application with only one tap, resulting in a smooth user experience when completing their onboarding process.

3. As a Primary Factor in Your Mobile Banking App’s Visibility, Use High-Intent Keywords and ASO

When it comes to the number of times users find your banking app, ASO is the most important factor. Therefore, for effective ASO for your banking apps advertising, you should include phrases like “mobile banking app advertising” and “secure banking apps”, as well as “best mobile banking services.” By doing this, you will have higher discoverability than you would by not including these keywords.

4. Use Psychological Techniques to Retarget Users and Show Them Personalized Ads

Using retargeting advertisements can help with getting visitors who showed interest in your app; however, they were not able to sign up for your app before dropping off (i.e., exited your app). Apptrove can help with identifying user behaviour patterns that you can then use to create personalized advertising impressions, which will improve user retention.

5. Advanced Attribution for Fraud Prevention

The presence of ad fraud presents a challenge to many of the advertising operations in the mobile banking app industry. Apptrove can essentially help you defend your advertising budgets from fraudulent activities by using its fraud detection abilities to ensure that only legitimate users receive your advertising dollars.

6. Utilizing Video and Influencer Marketing

Video advertising has been shown to have a 95% higher retention rate compared to static ads. Utilizing interactive videos with influencers also creates greater levels of trust among potential customers and has been shown to lead to more downloads.

The Role of Mobile Measurement Partners (MMPs)

MMPs (Mobile Measurement Partners) play a critical role in the tracking of app installs, as well as determining from where users are coming and what they are doing once they download. MMPs are impartial services that can provide you with data regarding how your marketing channels are performing. If you use an MMP, you will be able to better measure your results and optimize your advertising campaigns.

1. Complete Analytics: Provides the ability to analyze an ad campaign and its success through all available sources of data, such as user origins, user actions after downloading an app, and user conversion statistics.

2. Fraud Detection: Identifying fraud early on to determine return on advertising spend and loss is critical to maximizing a campaign’s ability to achieve the best possible ROI.

3. Cross-Channel Attribution: Determine how different advertising channels work together to contribute to your user acquisition efforts, and how to allocate budgets accordingly.

Why Choose Apptrove as Your MMP

Apptrove is a top-performing app measurement partner that provides cutting-edge Ad solutions for mobile banking applications.

1. Customized Dashboard: Customized dashboard features allow users to quickly create and configure dashboards so that they can view application performance metrics in real-time.

2. Easily Integrable: Easy integration with current marketing solutions ensures users have a seamless way to connect and obtain complete top-down analytics.

3. Dedicated Support: Apptrove provides expert support through its team that helps you optimize advertising strategies.

To achieve success with your mobile banking application advertising, companies must have various components working together as a system. Partnering with Apptrove and utilizing the processes outlined above will give your app the best chance to reach more end users and keep them engaged. Your mobile banking API performance can be significantly enhanced. Contact us for customized solutions and to see how we may satisfy your organization’s unique business needs.

FAQs

1. What is mobile banking app advertising?

Mobile banking app advertising is the strategy of promoting a banking app to attract valuable users and retain them through targeted campaigns, optimized app store presence, and engaging ad formats.

2. Why is mobile banking app advertising challenging?

High competition, user trust concerns, strict compliance rules, and difficulties in tracking ROI make it harder for financial institutions to promote their apps effectively.

3. How can Apptrove improve mobile banking app advertising results?

As a Mobile Measurement Partner (MMP), Apptrove provides precise attribution tracking, fraud prevention, audience segmentation, and actionable analytics to boost ROI.

4. What strategies work best for mobile banking app advertising?

Winning tactics include contextual targeting, deep linking for smooth onboarding, keyword optimization, retargeting with personalized ads, and leveraging video or influencer marketing.

5. Why should financial institutions choose Apptrove as their MMP?

Apptrove offers customized dashboards, seamless integration with existing tools, advanced fraud detection, and dedicated expert support for better campaign performance.