The return on investment is a very important metric that indicates how much profit or benefit you receive from an investment versus the cost incurred by the investment itself. This metric helps to make decisions as to whether or not an investment was worth the money spent (i.e., marketing campaigns, properties, projects, or any asset). The return on investment abbreviation/R.O.I. is an acronym, and it is easy to understand because it helps the reader remember what the return on investment really means.

Return on investment can be simplified to say: the amount of money put into an investment equals the amount of money taken out of that investment, or if a positive or negative amount is produced by that investment. In other words, if the return on investment is high and has a positive number, then it is a good investment. If the return on investment is low or negative, then the return on investment was not a good investment.

Businesses, investors, and marketers all utilize the return on investment concept daily to help them make financial decisions.

Why Return on Investment is Important

There are several reasons why ROI is so widely used:

1. It indicates how effectively money has been utilized relative to the amount of money it produced as revenue from that use.

2. It allows you to compare different projects/assets on a “like-for-like” basis.

3. It is a simple calculation that does not require an advanced financial background to comprehend.

4. It enables companies to determine where best to allocate their budget to achieve the greatest return on investment.

For mobile app marketers, it is critical to know your return on investment to maximize your app performance and return on marketing investment. Companies such as Apptrove allow you to accurately assess your return on investment across all forms of advertising so you can optimize performance across multiple marketing channels.

How Return on Investment is Used

Business

Return on Investment (ROI) provides an objective means for businesses to assess whether an investment or project is worthwhile, from buying new tools, creating new products, and expanding into new areas.

Marketing

ROI is used as a method to measure the success of marketing events. A typical scenario might involve your organization spending money on an advertisement or other promotional effort and later calculating the amount of revenue earned as a result of that effort. A positive ROI means that the campaign resulted in generating more revenue than was spent on it. Apptrove provides a variety of tools and metrics to assist with monitoring return on investment at each level of a marketing campaign.

Mobile App Growth

When you buy advertising in order to grow your app’s install base, you want to make sure that every dollar spent will result in greater growth for your app. By measuring ROI, you can identify which campaigns and/or advertising partners are delivering an actual return on your investment. Apptrove provides a dashboard for tracking ROI and identifying ad/marketing partners that provide value at both campaign and channel levels. With these tools, you will be able to optimize your advertising expenditures and scale your business effectively.

Property and Other Investments

Beyond just business and marketing, the concept of ROI is also applicable to other forms of investing, including real estate, stocks, and even personal investments. The ROI method allows you to calculate the potential benefit(s) of an investment before investing your money.

How to Calculate Return on Investment

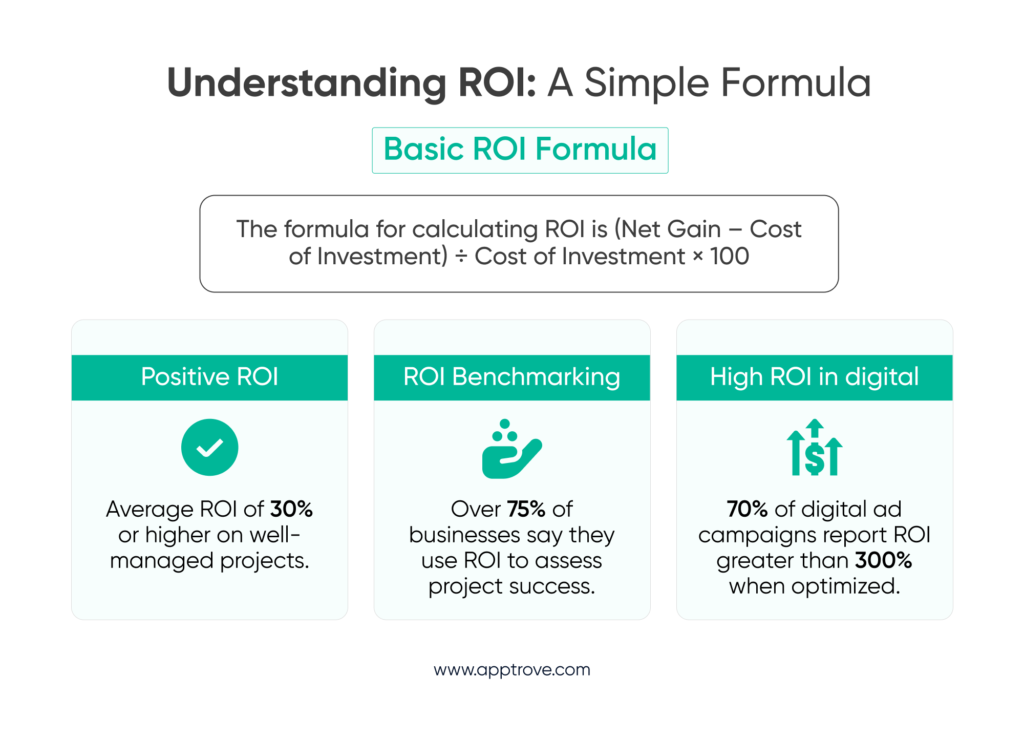

The simplest form of calculating your return on investment is to compare the profits you have made against the costs incurred. A common formula for ROI calculation is as follows: ROI = (Net Gain – Cost) / Cost x 100. Therefore, if you earn more than you spend, then your investment was successful and vice versa. The greater the percentage of profit earned in relation to the amount spent on an investment indicates greater the success.

To further clarify this:

Net Gain – refers to the total revenues generated by your investment after subtracting all expenses.

Cost – refers to all costs associated with investing, including interest, taxes, etc.

A return on investment (ROI) formula that can be easily calculated for assessing an investment’s profit is: ROI = (Net Profit/Cost) x 100 Which can be compared against other Investments or time frames.

For example, If you spend ₹50,000 to conduct a campaign, you would generate ₹75,000 in revenue from that campaign. Therefore, to determine your ROI:

Net Gain =

₹75,000 – ₹50,000 = ₹25,000

ROI =

(₹25,000/₹50,000) x 100 = 50%

For this campaign, you received 50% back on your original investment amount.

Good and Bad ROI

There isn’t a standard number for what constitutes as good or bad. It is contingent upon the industry, level of risk, length of time, and expectations surrounding an opportunity. In general:

- A positive return on investment indicates that the investment returned a profit.

- A large percentage return on investment indicates greater efficiency in the use of capital.

- Negative return on investment indicates loss of money.

When it comes to Marketing and App Growth, it is common to compare return on investment between different channels and campaigns to determine which ones have the highest return. Apptrove has created measurement solutions to facilitate this process.

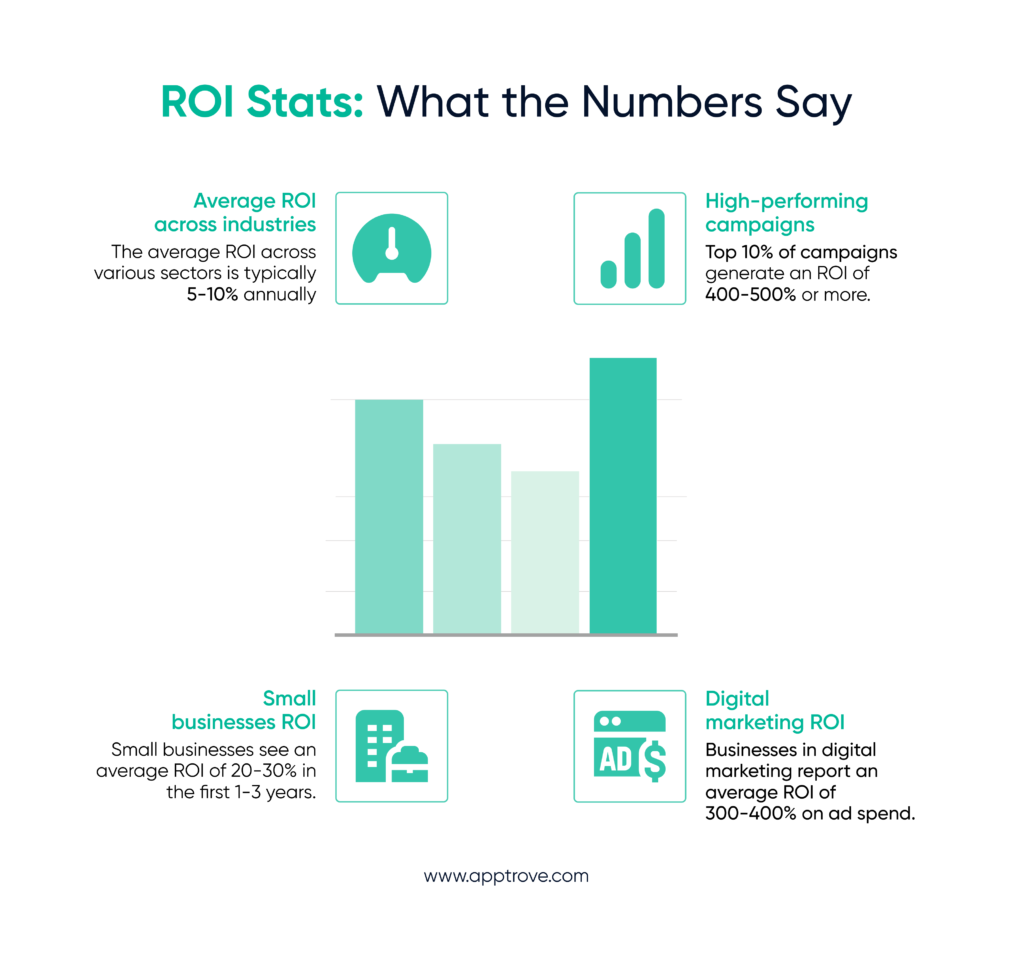

Return on Investment Across Different Vertical Markets

Return on Investment (ROI) is a flexible metric that measures the profitability of investments across many different types of industries. Below is a brief overview of how to utilize ROI for each respective Vertical Market:

1. Real Estate

Investors utilize the same formula used to calculate ROI to evaluate properties they are purchasing. For example, if an investor purchases a property for $200,000 and the investor receives a return of $250,000, the ROI will be 25% or a profitable investment.

2. E-Commerce & Retail-

Businesses in the e-commerce and retail marketplaces utilize return on investment (ROI) to determine how effective their marketing campaigns are and how much revenue they generate from their sales efforts. For example, if a company spends $10,000 on advertising and sells $15,000 worth of goods, the company’s ROI would be 50%. This indicates a successful marketing campaign.

3. Technology:

Companies determine the return on investment of technology purchases (software or infrastructure) by evaluating the financial return that results from the use of that technology against the initial investment. For example, if a company buys $50k worth of software and experiences $75k in cost savings, the company will have a 50% return on that technology purchase.

4. Marketing Metrics:

Marketers measure the return from advertising campaigns by calculating the return on investment. For instance, if a marketer spends $5,000 on a marketing campaign and generates $12,000 in revenue from that marketing campaign, the corresponding return on investment would be 140%, thus displaying a highly effective marketing tactic.

5. Social Media Advertising:

Return on investment is a critical component in evaluating the success of an advertisement on social media platforms, such as Facebook and Instagram. A $1,000 investment in Instagram ads generating $2,500 in sales produces a 150% return on that advertisement expenditure, and signifies how effective that advertisement expenditure was.

By determining return on investment for the three industries mentioned above, it is clear that return on investment provides an avenue for determining how well an organization is spending its money, in order for the organization to make sound financial decisions.

Limitations of Return on Investment:

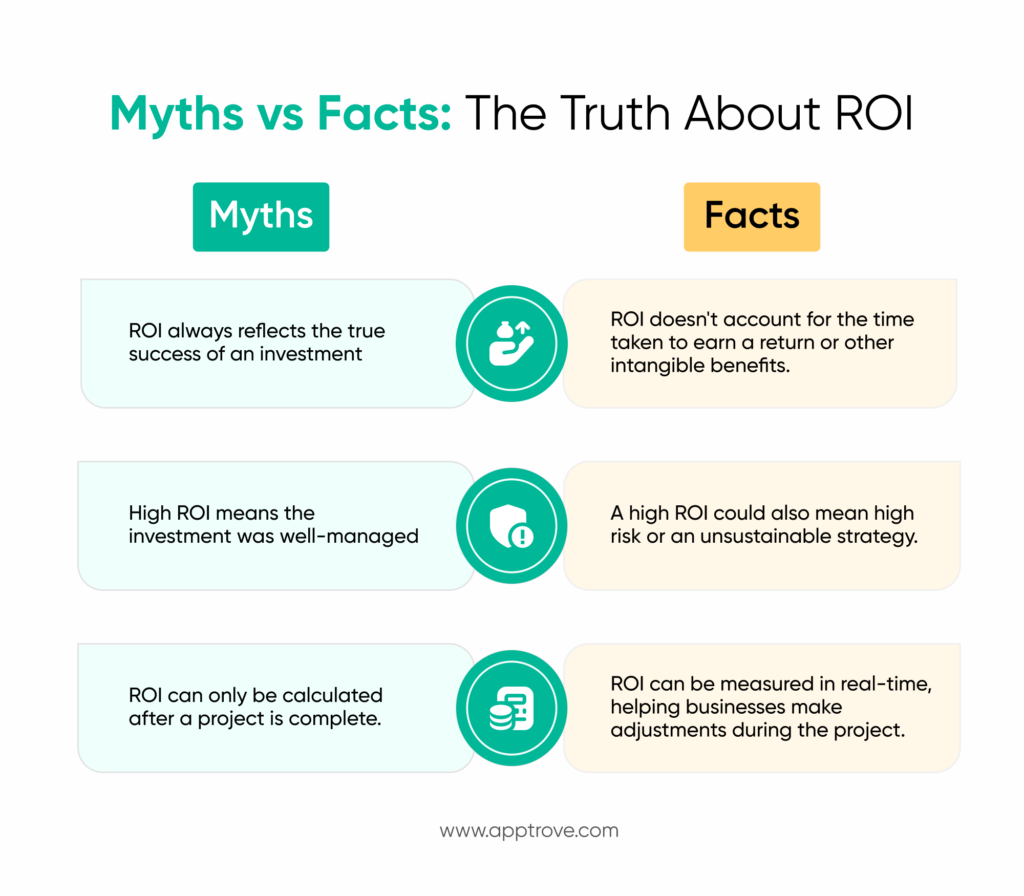

While return on investment is a useful financial metric, it does, however, have specific limitations:

- Return on investment does not typically account for the amount of time it takes the investment to yield a return.

- Alternative investments and risks may be overlooked in determining return on investment.

- Return on investment typically oversimplifies complex financial decisions by only focusing on percentage increases.

- Return on investment typically will not account for qualitative benefits, such as customer loyalty or brand equity.

For deeper insight, ROI is used alongside other metrics like Net Present Value (NPV) or Internal Rate of Return (IRR) when evaluating long-term projects.

Improving Your ROI

To maximize your return-on-investment:

- Minimize costs with no compromise on quality.

- Generate more net returns by implementing a superior strategy or utilizing more targeted methods.

- Utilize tools to measure data (e.g., Apptrove) so you can monitor real-time progress from day to day.

- Analyze the return-on-investment generated by each channel to identify which channels are generating the highest return.

Why is the Return-on-Investment Important to App Marketers?

For app marketers, return on investment is critical to determining if user acquisition and engagement are generating profitable returns. User acquisition costs can be substantial; thus, accurately calculating return-on-investment should help marketers reduce waste and focus on campaigns that deliver measurable returns. Platforms that provide a consolidated view of all your channels and attribution, such as Apptrove, make it easier for marketers to track their return on investment from all channels.

FAQs

1. What is ROI?

Return-on-investment is the percentage of how much money you have made (or lost) by investing money compared to the amount you invested. It provides information about whether your return-on-investment is positive or negative.

2. How do I calculate ROI?

You will use the formula below to calculate ROI:

ROI = (Net Gains – Cost of Investment) ÷ Cost of Investment × 100.

This will give you a simple percentage of your profit.

3. What is ROI in business?

In business, ROI is a metric used to decide whether business projects or purchases are profitable by comparing returns to costs.

4. What is ROI in marketing?

In marketing, ROI measures how much revenue a campaign generates compared with how much was spent. It shows how effective marketing spend was.